Your driving history is just one of the aspects insurer utilize to help identify your rates, which indicates an accident or a website traffic ticket can have a substantial influence on how much you pay for insurance coverage (car insurance). Maintaining your driving document tidy is the simplest and also most effective method to maintain your insurance costs reduced.

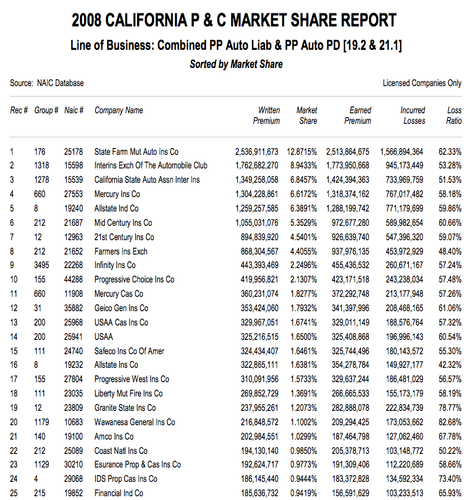

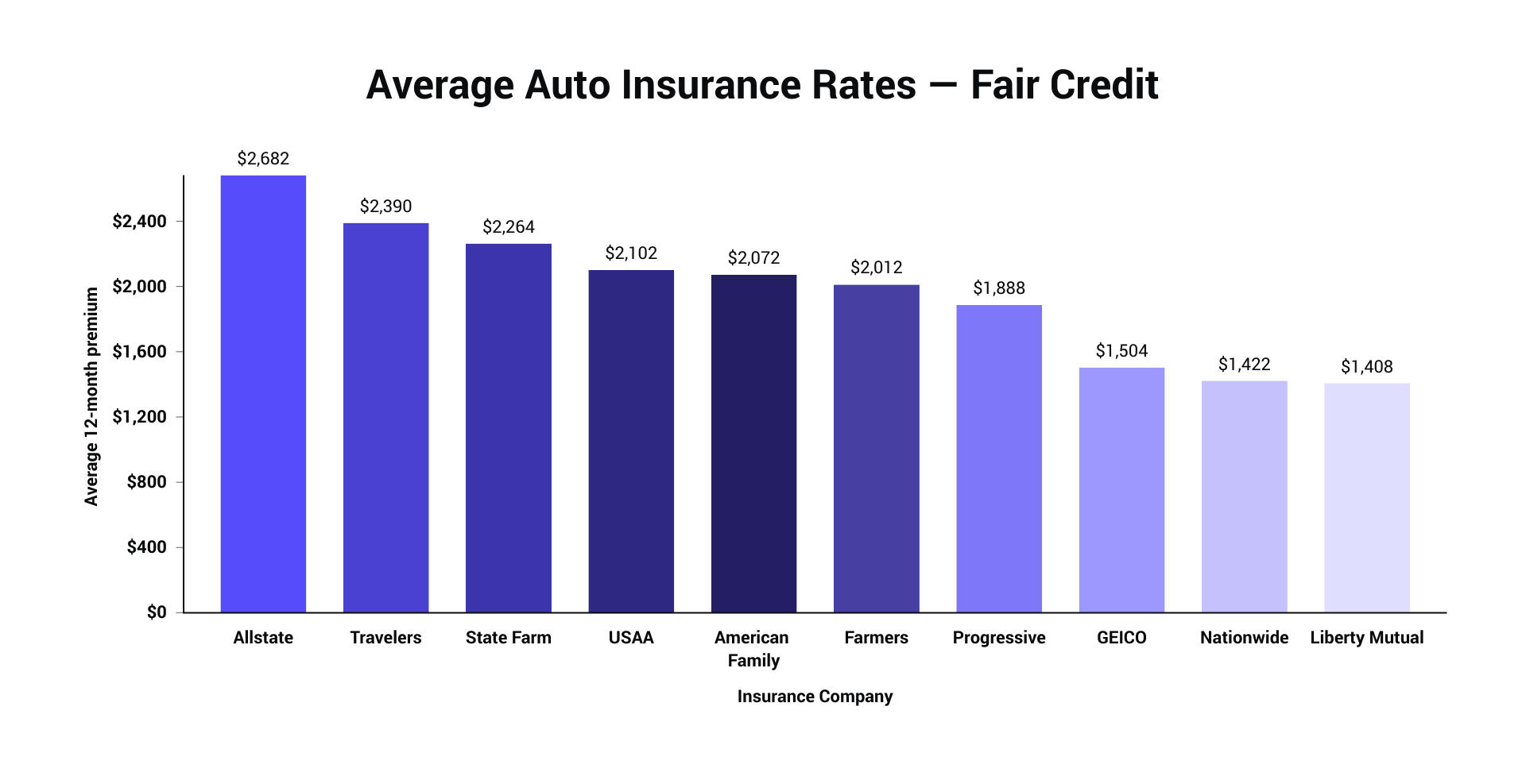

Insurance companies in some states price chauffeurs based on their credit rating. cheap auto insurance. Theoretically, this is because motorists with lower credit history are most likely to sue as opposed to spending for damages out-of-pocket, yet in practice it often finishes up unfairly penalizing some vehicle drivers. As a result of this, The golden state regulations protect against insurance companies from score based on credit rating background.

Frequently asked questions, Exactly how much is cars and truck insurance per month in California? Vehicle drivers in The golden state pay an average of $1,857 per year for cars and truck insurance, which damages down to $154.

cheap insured car perks credit score

cheap insured car perks credit score

Is California a fault or no mistake state? The golden state is an at-fault state, which implies a vehicle driver that is at mistake in a crash is accountable for the bodily injury and also property damage costs caused by the accident, whether or not they have sufficient car insurance policy to cover those prices. auto.

cheaper cheapest car car low cost auto

cheaper cheapest car car low cost auto

Rates for driving infractions and "Poor" credit scores identified making use of ordinary prices for a solitary man 30-year-old vehicle driver with a credit history score under 578. Your actual quotes might vary.

The smart Trick of Insurance And Benefits With A Purpose - Guardian That Nobody is Discussing

There are lots of things to see and carry out in The golden state, as well as you're mosting likely to need an auto if you desire to experience every little thing - cheaper cars. And having a car implies having inexpensive cars and truck insurance policy. While car insurance coverage is very easy sufficient to locate, economical isn't so easy to locate. Which's why most of California chauffeurs are convinced they are paying excessive for insurance coverage.

We are going to walk you with every little thing you need to understand to get trustworthy coverage at the very best possible price! Exactly How Does Car Insurance Coverage Work? Among the factors that low-cost car insurance policy in California is hard to discover is that numerous drivers don't know that much about auto insurance policy. vehicle insurance.

On the a lot of standard level, auto insurance helps protect you and other drivers on the roadway. Insurance coverage aids to pay for the damages that we cause to others or that create to us as an outcome of a car mishap or other qualifying occasion (affordable). Different kinds of insurance coverage protect you as well as your automobile in various sort of ways.

However, accident insurance coverage spends for damages to your auto despite that was at fault. Detailed insurance policy aids cover points that could occur to your car when you're not driving (such as burglary and criminal damage). The more levels of vehicle insurance coverage you have, the much more defense you and your car have versus injuries and damage.

cheap affordable auto insurance affordable laws

cheap affordable auto insurance affordable laws

If you wish to get economical car insurance, you require to discover the balance in between just how much protection you need as well as just how much money you agree to pay each month. vehicle insurance. That's where Cost-U-Less Insurance policy can help. Is Cars And Truck Insurance Affordable for Californians? As we claimed before, the majority of California vehicle drivers are encouraged they are paying too a lot for auto insurance policy (insure).

Not known Facts About Healthcare.gov: Get 2022 Health Coverage. Health Insurance ...

The typical cost of complete insurance coverage automobile insurance policy in The golden state is $172/month. For the minimal responsibility car insurance coverage, Californians are paying about $61/month. The nationwide ordinary price of full protection car insurance coverage is $139/month, while the ordinary minimal vehicle insurance policy protection is $47/month. Although you live and also drive in California, this number may not precisely reflect exactly how much you pay for car insurance.

insurance company cheaper auto insurance laws auto

insurance company cheaper auto insurance laws auto

Vehicle insurance coverage costs depend upon numerous elements, some within your control and some beyond your control. Agents at Cost-U-Less Insurance policy are skilled in finding means to aid you make the many of your insurance dollars. What is the Typical Automobile Insurance Coverage Cost in California? Generally, motorists in California pay $172/month for complete coverage cars and truck insurance coverage (cheaper).

Their average, as a matter Click here for more of fact, is $174. San Franciso vehicle drivers pay an average of $233. Drivers in San Diego are best around the state standard with $170. However chauffeurs in Los Angeles are really emptying those budgets: their typical cost of automobile insurance policy is a tremendous $274! Lengthy story short? The location you reside in is among the significant variables that cars and truck insurance service providers use to identify how much you pay on your monthly costs.

insurance affordable insurance cheap car insurance low-cost auto insurance

insurance affordable insurance cheap car insurance low-cost auto insurance

Contrast Cars And Truck Insurance Policy Rates Currently you recognize that various elements assist figure out just how much you spend for vehicle insurance policy (risks). One of one of the most dependable ways to lower your automobile insurance policy premium is to contrast different insurance providers, which is something we specialize in at Cost-U-Less Insurance coverage. If you pay for your insurance one month at once, you can usually exchange insurance coverage carriers whenever you wish to - auto.

If you don't have cars and truck insurance, your driver's certificate might get put on hold and your car seized. After suspension, you need to submit and also keep proof of auto insurance policy with the California Department of Electric motor Vehicles for three years. Insurance provider will send you a card to reveal proof of car insurance coverage, so make certain to maintain it in your lorry to stay clear of these repercussions (auto insurance).

Best Car Insurance Companies In California - Cars.com for Beginners

Mercury enjoys an unique setting in the industry providing its customers with several of the state's most budget-friendly and also personalized agent-driven solution. Mercury supplies greater than 1,000 independent representatives in The golden state. Contact one for a cost-free price quote and begin saving today. California Car Insurance Coverage Discounts & Advantages Mercury currently offers a few of the most affordable insurance rates available.

Considering that then, it's not only come to be the biggest economic situation in America but also the fifth-largest economic situation on the planet, vanquishing the UK. auto. It's not a surprise since The golden state deals a lot, from the glittering oceans in San Diego all the way up to the beautiful mountains of Sierra Nevada.